Be Rational and Be a Life Long Learner

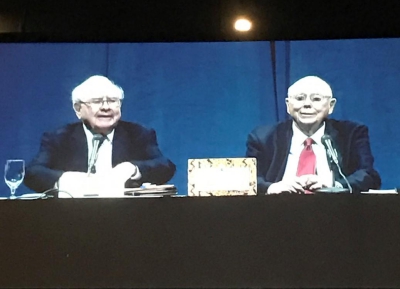

We again attended the Berkshire Hathaway Annual Shareholders Meeting in Omaha Nebraska. The event, which draws a crowd of 40,000, provides access to two of the great investing minds of all time, Warren Buffett and Charlie Munger. Buffett, the Chairman is 86 and Munger, Vice Chairman, is 93. The two have been in partnership at Berkshire Hathaway for 52 years.

It was Tom’s fifth consecutive visit to Omaha for the meeting and Will’s second – Will attended the 50th Anniversary Meeting in 2015.

For those less familiar with the company, Berkshire Hathaway is an American multinational conglomerate holding company. The company wholly owns GEICO, BNSF Railway, Lubrizol, Dairy Queen, Pampered Chef, and NetJets, and also owns 43.6% of the Kraft Heinz Company. It also has significant minority holdings in American Express, The Coca-Cola Company, Wells Fargo, IBM and Apple.

Berkshire Hathaway averaged an annual growth in book value of 20.8% to its shareholders for the last 52 years (compared to 9.7% from the S&P 500 with dividends included for the same period), while employing large amounts of capital, and minimal debt. To put that into perspective and to highlight the power of compound interest, $1 invested in Berkshire Hathaway in 1964 is now worth $19,726. That same dollar invested in the S&P500 would be worth $127. That is why they call Warren Buffett “The Oracle of Omaha”.

We gain great insights from the meeting. Buffett and Munger speak for more than five hours in a Question and Answer format. The questions come from Financial Journalists, Stockbroking Analysts and Shareholders at the meeting. The duo field almost 60 questions across a range of topics. They have no prior guidance on what the topics are. Buffett takes the lead in answering the questions and then turns to Charlie. Munger adds a quip, a profound statement or additional investment opinion. Many of his comments are met with laughter. Often Buffett covers the question adequately enough for Munger to simply reply “I have nothing to add”.

Warren Buffett is the greatest investor of all time. However, he said he wants his legacy to be one where he is remembered as a teacher. His commitment to this is evident at the meeting and his detailed Annual Letter to shareholders. He is a lifelong learner and shares his learnings with the Berkshire faithful. He is humble, he has strong business ethics and is shareholder orientated.

As with previous years, this trip is self-funded and no cost is borne by BKI Investment Company.

The meeting itself is held at CenturyLink Center (pictured above). Berkshire Hathaway also showcases its companies at the Exhibition Center that forms part of the building. Here you can buy Brooks running shoes, Coca-Cola, jewellery or furniture. The industrial companies such as BSNF (rail), Precision Castparts or Netjets also exhibit at the expo which gives us a wonderful chance to talk to management teams. One strength of Berkshire Hathaway is its diversified portfolio of businesses. A visit to the Meeting provides a great insight into the broader US economy.

On the day of the meeting, we found ourselves wide awake at 2:30 a.m. battling jet lag. So we decided to head to the venue and start lining up. We were first in line at one of the many entrances by 3:15 a.m. ahead of the doors opening at 7 a.m.. We weren’t first there by any measure. There was an enormous group of Chinese investors who had been lining up since 1 a.m. We were later told that an organised tour of 3,000 Chinese investors had flown to Omaha for the event.

When the doors opened we were first through and raced into the venue. Our commitment to the early start paid off and we were rewarded with front row seats. The meeting itself begins at 8:30 a.m. with a corporate video and a number of advertisements for some of Berkshires key brands, including Geico Insurance, Coca- Cola, Berkshire Hathaway Energy and Brooks.

Then it is in to the Q&A session. In prior years, it was not uncommon for an underlying theme to portray itself throughout the day. Last year, Amazon was a strong theme for example. The discussion was more varied this year. Nevertheless, a number of topics always play out at the meeting including:

- Approach to valuing companies

- Where does Buffett see value?

- And, for some shareholders, they simply want life advice from Buffett and Munger

We have divided this note up into different topics and end with a number of additional quotes and miscellaneous material. We hope you enjoy reading the note and we welcome any questions you may have – simply send them to info@bkilimited.com.au

Our early start meant that we secured front row seats.

Investment Opportunities are Becoming Harder to Find

One topic that did repeat during the day was that compelling opportunities are getting more difficult to find. When speaking about the 2016 acquisition of Precision Castparts for US$37 billion, Charlie Munger stated “this is no screaming bargain like the old days”. The other challenge that Berkshire has is its size. With a market capitalisation in excess of $400 billion, transactions need to be significant to have a material impact on Berkshire.

On acquisitions, it’s about the business itself. “It’s not about this field or that field” Buffett said. He and Munger know within a few minutes of getting a call from a company looking to sell whether the investment is for them. Its about the business’ returns, and also if they can understand the business.

On acquisitions, it’s about the business itself. “It’s not about this field or that field” Buffett said. He and Munger know within a few minutes of getting a call from a company looking to sell whether the investment is for them. Its about the business’ returns, and also if they can understand the business.

Making an acquisition is competitive, Munger said. “There’s a huge industry of doing these Leveraged Buyouts — that’s what I still call them.” The rest of the market calls them Private Equity. Munger noted that “Deals have become harder because these Private Equity firms are able to borrow at such low rates.” Berkshire is not inclined to use debt. It already has significant leverage through using its Insurance Company’s free float. Berkshire is one of the few insurance companies in the world to invest its free float (which is premium income yet to be paid out) in Equities.

Despite the absence of screaming bargains, we were reminded that often quality is worth paying up for. See’s Candy, which was acquired in 1972, was used as an example. The See’s Candy acquisition seemed to be a pivotal transaction in the investing career of Buffett and Munger. Berkshire paid $25 million for See’s Candy and Munger noted that they were right to pay a slightly higher price than they wanted to. See’s Candy was a valuable lesson for Berkshire on the importance of a durable competitive advantage and brand. See’s Candy taught Buffett and Munger how powerful a strong brand is. They said they wouldn’t have bought Coca Cola if they hadn’t learned this lesson. Buffett noted that the power of a brand creates an “unending flow of money for no work.” See’s Candy now makes almost $100 million a year. “We paid $25m and the business was earnings $4m pre-tax. Since then, we’ve taken $2 billion in capital out . . . We continue to look for more See’s – just on a much larger scale.” Buffett said.

Durable competitive advantage is important. Buffett advised that, when investing, you need to make a judgement about the ability to ward off competition. “If you have a great business you will always have competitors trying to take your business away from you. You need a good moat around your castle and a good knight in the castle making sure the marauders don’t get in.”

He added that “When competition comes along, we look at how this competition will impact the competitive position of the business we own. We want to ensure the competitive position is durable.” Charlie Munger complemented this comment by saying that “We had a habit of buying horrible businesses because they were so cheap. We’ve stopped doing this”.

But sitting in cash is not a long-term option. With interest rates so low, Buffett noted that cash essentially has a P/E of 100x.

What would prompt Berkshire to start putting its cash to work? Essentially, Buffett said that Berkshire wants to acquire businesses that will have a competitive advantage over the next 5 to 10 years, whose management teams are strong, and that are offered at a fair price.

Berkshire also noted that it was finding it more difficult to find capital-light businesses to invest in at reasonable valuations. They noted that the world has changed a lot – one can create enormous amounts of market value without a lot of tangible assets – a nod to the likes of Amazon.

When buying whole businesses, Berkshire is looking for managers who want to sell but want to stay in the business. “They love the business so much they don’t want to see it dressed up for resale,” he said.

Two segments of Berkshire’s listed equities portfolio that received attention were the more recent investment in the Airlines and investments in the Technology sector.

Berkshire is now the biggest shareholder of the four major American Airlines (Southwest, Delta, American and United). It is a sector bet and an interesting one as Buffett has almost always criticized the economics of the industry. He made the comment that traditionally you couldn’t pick a tougher industry. There are over 100 airlines that have gone bankrupt.

Why has Berkshire now invested in the airlines after years of being so airline averse? Essentially, the industry has changed. Consolidation has meant that capacity utilisation has improved to be above 80%. Buffett now thinks that the odds are high of growing revenue per passenger. He also noted that all four airlines Berkshire owns have been producing solid returns on invested capital and have been buying back stock quite aggressively. Berkshire likes this combination. Finally, the airline stocks were bought at low P/E multiples.

On Technology stocks, Berkshire has invested in Apple (now almost a $20 billion stake) and reduced the exposure to IBM, where Buffett recently sold a third of his stake, valued at approximately $5 billion. He noted that while Berkshire didn’t lose a lot of money on IBM, he thought it would do better. The bigger regret is the opportunity cost of what he could have invested in.

On Apple, Munger made the following comment: “Buying Apple shares . . . it shows one of two things about you Warren – either you’ve gone crazy or you’re learning”.

Buffett said “We consider Apple a consumer products business – so determining its moat was a matter of understanding consumer behaviour.”

Traditionally Berkshire has avoided the tech stocks as “we didn’t have any insights or know more than anyone else. There were others that knew the space better”.

Investing Mistakes

Most first time visitors to the Berkshire Meeting would be struck by the humility of Buffett and Munger. They constantly reflect on their mistakes and take responsibility. We too were advised to “learn from your failures”. Buffett and Munger spoke about their early experiences and how difficult it is to try to fix the unfixable from investing in cheap, low quality businesses. “There is nothing like the pain of being in a really lousy business to make you appreciate being in a really good one.”

Most first time visitors to the Berkshire Meeting would be struck by the humility of Buffett and Munger. They constantly reflect on their mistakes and take responsibility. We too were advised to “learn from your failures”. Buffett and Munger spoke about their early experiences and how difficult it is to try to fix the unfixable from investing in cheap, low quality businesses. “There is nothing like the pain of being in a really lousy business to make you appreciate being in a really good one.”

The encouragement of lifelong learning is a consistent message in all Berkshire meetings. As Munger said: “A life properly lived is to learn, learn, learn all the time. If we hadn’t been continuously learning, you wouldn’t be here”.

He also said: “We don’t unlearn the old tricks and that is really important,”

Buffett and Munger conceded that they missed investing in both Amazon and Google which has been a mistake. On Amazon, it was early and they failed to grasp the strategy on the Cloud side of the business. On Google, they noted they shouldn’t have missed it as they saw the importance of Google for the Geico Insurance business. Google was charging Geico $11/click. Reflecting on Google, Buffett said: “We’ve missed a few things and we will continue to miss things.” To which, Munger replied “But we haven’t missed everything”.

New Technologies and Disruption

The increased prevalence of Exchange Traded Funds (ETFs) was also discussed. ETFs are said to account for over 30% of the US Market and Buffett is a proponent of the model. When asked to expand on this, he said “It’s the best investment for people looking for the least amount of worry.”

Previously, Buffett has referred to an investment in a S&P 500 index fund as a bet on American business, which is almost certain to do well over long periods of time.

In some ways, the ETF model is similar to the BKI / Listed Investment Company model. The investor gets access to a diversified portfolio of stocks at a low fee. The difference is that ETFs are tied to an index. We intend to delve into this comparison in a future Quarterly Report. John Bogle, the founder of Vanguard and the concept of ETFs was at the meeting and Buffett noted that “Jack Bogle has probably done more for the American investor than any man in the country.” Buffett, like BKI and Contact, has a problem with excessive fee structures. In our opinion, investors are increasingly shirking at the concept of paying >1% per annum to a fund manager for lacklustre performance. ETFs (or passive management) are disrupting the funds management industry.

Driverless technology is a threat to the insurance industry. In addition, driverless trucks would be negative for the BNSF (Berkshire’s rail business that it acquired in 2009 for $34 billion). Berkshire’s view is that driverless technology will come but is a long way off.

Disruption in the Retail Sector

Buffett said that “anyone who thinks that online isn’t going to have a big impact on retail is mistaken.” He said that Nebraska Furniture Mart is yet to see a big negative impact from online. More sales have gone online and now account for 10% of sales.

A strong brand is increasingly important in an online world

On Amazon, a comment was made that “Jeff Bezos is the business mind of our generation.” Buffett went on to say that “It is hard to think of a situation where one person has built such an extraordinary economic machine in two industries, retail and cloud, from scratch”.

There was a question on Artificial Intelligence. Buffett believes that the success of Artificial Intelligence will result in less people working but an improvement in productivity. This is a good thing but one that requires massive transformation. For example, Geico has 36,000 employees. If that could be done with 6,000 employees, then that is a massive adjustment. Munger is sceptical on the timing of A.I. and doesn’t think it will happen that quickly.

Importance of Reputation in a World Increasingly Filled with Compliance

The holding in Wells Fargo (Berkshire’s biggest stock holding at $27.6 billion) was questioned after a year where the group was scrutinized for questionable sales practices. Wells had decentralized the structure and incentives too much to the local banks. The question explored whether Berkshire was exposed to a similar risk given its policy of “delegation to the point of abdication”

Buffett said that Berkshire relied very heavily on the integrity of its management. He referred to his time at Salomon Brothers in the early 1990s. Buffett has become renowned for a comment he made in his speech to the Senate when he stepped in as Salomon Brothers interim-Chairman: “Lose money for the firm and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.”

Buffett spent time talking about the importance of reputation. He spoke about the importance of establishing the right culture – this is more important than a 1,000 page compliance handbook. The pair quoted Benjamin Franklin when they said that “an ounce of prevention is worth a pound of cure”.

Buffett said “We believe the right culture will self select the right people … Berkshire has 370,000 employees, there is little doubt someone is doing something wrong at the moment. It is not the fact that someone is doing something wrong, the issue is if the manager fails to correct and report the behaviour.”

“You don’t need more compliance — you just need to do a better job at picking the right people” added Munger.

Buffett has written previously: “We can’t be perfect but we can try to be. As I’ve said in these memos for more than 25 years: “We can afford to lose money — even a lot of money. But we can’t afford to lose reputation — even a shred of reputation.

We must continue to measure every act against not only what is legal but also what we would be happy to have written about on the front page of a national newspaper in an article written by an unfriendly but intelligent reporter.

A reluctance to face up immediately to bad news is what turned a problem at Salomon from one that could have easily been disposed of into one that almost caused the demise of a firm with 8,000 employees.”

He also stressed the importance of what you incentivise. Incentives are an enormous part of human behaviour. The incentives at Wells Fargo led to the wrong type of behaviour. But the biggest issue (at both Salomon and Wells Fargo) was that the CEO didn’t act. Problems don’t simply go away – management needs to act.

Political / Macro Related

There were very few comments on Donald Trump – we thought there might have been more discussion. Buffett did note that President Trump is trying to pressure US companies to create jobs and bring back offshored jobs.

There was talk about tax cuts. The bigger issue challenging America’s growth is the rising cost of medical care. Medical costs are the “tapeworm” of American economic growth, Buffett said.

Munger also said there’s too much spending on medical intervention. “On this issue, both parties hate each other so much that neither one of them can think rationally.”

Renewables

Berkshire Hathaway Energy subsidiaries would continue closing on more renewable energy deals in the capital-intensive utilities business. They did concede that the economics of large scale renewables don’t stack up, adding it helps that wind and solar projects are subsidized by federal tax credits. Just like the company-wide earnings that are repatriated into capital projects, so do tax credits get reinvested back into the energy businesses.

Simply put, Buffett said: “We’ve got a big appetite for wind or solar (projects). If someone walks in with a solar project tomorrow and it takes $1 billion or $3 billion, we’re ready to do it.”

“We have an advantage in that others are trying to be brilliant. We are just trying to be rational.” – Charlie Munger

Other advice / selected snippets from the meeting

- When you meet a company, ask about competitors (i.e. “Who of your peers would you buy / who would you short?”)

- On Berkshire’s investment success, Munger said “We have an advantage in that others are trying to be brilliant. We are just trying to be rational. It can be very dangerous being brilliant.”

- On investing versus speculating – people like action and like to gamble. But a day of reckoning will eventually come for speculators. “Fear can then take control like you wouldn’t believe. The way the public acts creates irrationality and speculation.” This view goes some way to explaining why Buffett likes to always have at least $20 billion in cash ready for opportunities. He noted that Berkshire rarely spends time looking at the macro picture – Berkshire is opportunistic.

- One question they often ask themselves: Do we know enough about this opportunity to invest in it?

- On finding investment opportunities, Charlie Munger quoted a friend who says “The first rule of fishing is to fish where the fish are. The second rule is not to forget the first rule!”

- Buffett wants Managers of his businesses to think like shareholders. He asks every CEO he meets (of S&P500 companies): What would you do differently if you owned the whole business yourself?

- “We prefer to buy companies that are already running efficiently, because, frankly, we don’t enjoy the process at all of getting more productive” (i.e. laying off employees).

- The following comment was in the Annual Letter but is worth repeating: “When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.”

- “The other guy is doing it so we must as well spells trouble in any business, but none more so than insurance”

- Charlie joked that someone once asked Warren what he would want to be said at his funeral, to which he replied “That’s the oldest looking corpse I ever saw!”

- Warren retold a comment that Charlie once made: “Tell me where I am going to die so I never go there”

Will Culbert and Tom Millner

May 2017

The material contained within the Berkshire Hathaway 2017 AGM Report (The Report) has been prepared by BKI Investment Company Limited. Figures referred to in The Report are unaudited. The Report is not intended to provide advice to investors or take into account an individual’s financial circumstances or investment objectives. This is general investment advice only and does not constitute advice to any person. The opinions within The Report are not intended to represent recommendations to investors, they are the view of BKI Investment Company Limited as of this date and are accordingly subject to change. Information related to any company or security is for information purposes only and should not be interpreted as a solicitation of offer to buy or sell any security. The information on which The Report is based has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy or completeness. Investors should consult their financial adviser in relation to any material within this document.