BKI aims to generate an increasing income stream in the form of fully franked dividends, to the extent of available imputation tax credits, through long-term investment in a portfolio of assets that are also able to deliver long term capital growth to shareholders. All historical dividends paid have been fully franked.

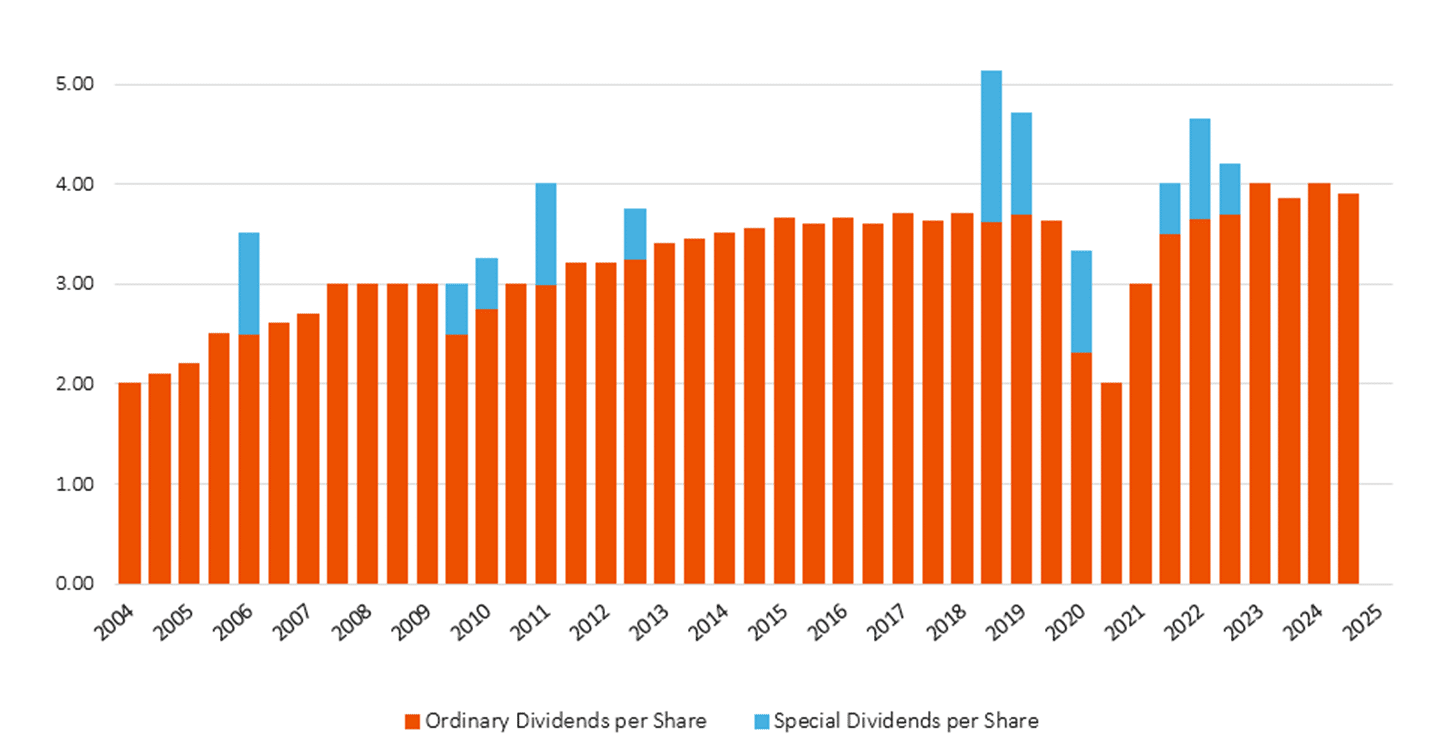

As can be seen in the chart below, BKI has been able to increase Ordinary Dividends paid to shareholders through long term investing in good quality dividend paying companies. BKI has also distributed to shareholders eight fully franked Special Dividends since listing.

BKI Dividends Paid to Shareholders

BKI has paid out $1.27 per share, or over $922m in dividends and franking credits to shareholders since listing in 2003*

Note: Grossed up yield includes franking credits and is based on a tax rate of 30%. # Includes FY2022 Interim Dividends.

| BKI – Dividend History & DRP Pricing | |||||

| Ex-Dividend Date | Special | Dividend Per Share (cents) | Franking (%) | DRP Price * | Pay/ Issue Date |

| 10-Aug-04 | 2.00 | 100 | N/A | 31-Aug-04 | |

| 16-Feb-05 | 2.10 | 100 | $1.13 | 28-Feb-05 | |

| 15-Aug-05 | 2.20 | 100 | $1.15 | 31-Aug-05 | |

| 22-Feb-06 | 2.50 | 100 | $1.32 | 10-Mar-06 | |

| 17-Aug-06 | 2.50 | 100 | $1.29 | 31-Aug-06 | |

| 17-Aug-06 | S | 1.00 | 100 | $1.29 | 31-Aug-06 |

| 26-Feb-07 | 2.60 | 100 | $1.36 | 16-Mar-07 | |

| 17-Aug-07 | 2.70 | 100 | $1.42 | 31-Aug-07 | |

| 18-Feb-08 | 3.00 | 100 | $1.23 | 7-Mar-08 | |

| 18-Aug-08 | 3.00 | 100 | $1.25 | 29-Aug-08 | |

| 20-Feb-09 | 3.00 | 100 | $0.80 | 12-Mar-09 | |

| 17-Aug-09 | 3.00 | 100 | $1.14 | 4-Sep-09 | |

| 22-Feb-10 | 2.50 | 100 | $1.24 | 12-Mar-10 | |

| 22-Feb-10 | S | 0.50 | 100 | $1.24 | 12-Mar-10 |

| 23-Aug-10 | 2.75 | 100 | $1.16 | 10-Sep-10 | |

| 23-Aug-10 | S | 0.50 | 100 | $1.16 | 10-Sep-10 |

| 15-Feb-11 | 3.00 | 100 | $1.24 | 7-Mar-11 | |

| 11-Aug-11 | 3.00 | 100 | $1.10 | 31-Aug-11 | |

| 11-Aug-11 | S | 1.00 | 100 | $1.10 | 31-Aug-11 |

| 24-Feb-12 | 3.20 | 100 | $1.17 | 12-Mar-12 | |

| 10-Aug-12 | 3.20 | 100 | $1.23 | 30-Aug-12 | |

| 12-Feb-13 | 3.25 | 100 | $1.47 | 28-Feb-13 | |

| 12-Feb-13 | S | 0.50 | 100 | $1.47 | 28-Feb-13 |

| 13-Aug-13 | 3.40 | 100 | $1.56 | 29-Aug-13 | |

| 11-Feb-14 | 3.45 | 100 | $1.61 | 27-Feb-14 | |

| 12-Aug-14 | 3.50 | 100 | $1.66 | 28-Aug-14 | |

| 12-Feb-15 | 3.55 | 100 | $1.75 | 26-Aug-15 | |

| 05-Aug-15 | 3.65 | 100 | $1.60 | 26-Aug-15 | |

| 04-Feb-16 | 3.60 | 100 | $1.59 | 26-Feb-16 | |

| 05-Aug-16 | 3.65 | 100 | $1.60 | 26-Aug-16 | |

| 10-Feb-17 | 3.60 | 100 | $1.64 | 27-Feb-17 | |

| 04-Aug-17 | 3.70 | 100 | $1.64 | 23-Aug-17 | |

| 12-Feb-18 | 3.625 | 100 | $1.68 | 28-Feb-18 | |

| 10-Aug-18 | 3.70 | 100 | $1.55 | 29-Aug-18 | |

| 08-Feb-19 | 3.625 | 100 | $1.52 | 28-Feb-19 | |

| 08-Feb-19 | S | 1.50 | 100 | $1.52 | 28-Feb-19 |

| 09-Aug-19 | 3.70 | 100 | $1.61 | 29-Aug-19 | |

| 09-Aug-19 | S | 1.00 | 100 | $1.61 | 29-Aug-19 |

| 08-Feb-20 | 3.625 | 100 | $1.68 | 27-Feb-20 | |

| 07-Aug-20 | 2.32 | 100 | $1.42 | 27-Aug-20 | |

| 07-Aug-20 | S | 1.00 | 100 | $1.42 | 27-Aug-20 |

| 05-Feb-21 | 2.00 | 100 | $1.51 | 25-Feb-21 | |

| 06-Aug-21 | 3.00 | 100 | $1.62 | 26-Aug-21 | |

| 11-Feb-22 | 3.50 | 100 | $1.62 | 03-Mar-22 | |

| 11-Feb-22 | S | 0.50 | 100 | $1.62 | 03-Mar-22 |

| 09-Aug-22 | 3.65 | 100 | $1.69 | 30-Aug-22 | |

| 09-Aug-22 | S | 1.00 | 100 | $1.69 | 30-Aug-22 |

| 10-Feb-23 | 3.70 | 100 | $1.78 | 28-Feb-23 | |

| 10-Feb-23 | S | 0.50 | 100 | $1.78 | 28-Feb-23 |

| 11-Aug-23 | 4.00 | 100 | $1.77 | 29-Aug-23 | |

| 05-Feb-24 | 3.85 | 100 | $1.76 | 27-Feb-24 | |

| 06-Aug-24 | 4.00 | 100 | $1.70 | 29-Aug-24 | |

| 03-Feb-25 | 3.90 | 100 | TBA | 24-Feb-25 | |

| * Note that DRP was introduced on 16/12/2005 | |||||

| BKI – Pricing of Equity Raisings (excluding take-overs & DRP) | |||||

| Nature of Equity Raising | Issue Price | Issue Date | |||

| Initial IPO | $1.00 | 9-Dec-03 | |||

| Share Purchase Plan | $1.075 | 9-May-05 | |||

| Share Purchase Plan | $1.330 | 9-May-06 | |||

| Rights Issue | $1.350 | 4-May-07 | |||

| Placement via Dixons | $1.450 | 4-Sep-07 | |||

| Share Purchase Plan | $1.200 | 7-Apr-08 | |||

| Share Purchase Plan | $1.180 | 30-Sep-09 | |||

| Share Purchase Plan | $1.290 | 8-Nov-12 | |||

| Institutional Placement | $1.480 | 12-Sep-13 | |||

| Rights Issue | $1.480 | 24-Oct-13 | |||

| Share Purchase Plan | $1.655 | 8-Aug-14 | |||

| Share Purchase Plan | $1.550 | 06-May-16 | |||

| Share Purchase Plan | $1.580 | 22-Jun-17 | |||

| Entitlement Offer | $1.500 | 26-Jun-18 | |||

| Share Purchase Plan | $1.660 | 30-Mar-23 | |||