BKI is a Listed Investment Company on the Australian Securities Exchange. BKI is focused on investing in quality companies for the long-term that have a history of and are expected to continue to pay attractive and growing dividends.

Managed by Contact Asset Management at a competitively low cost, BKI aims to provide shareholders with a consistent income stream in the form of fully franked dividends.

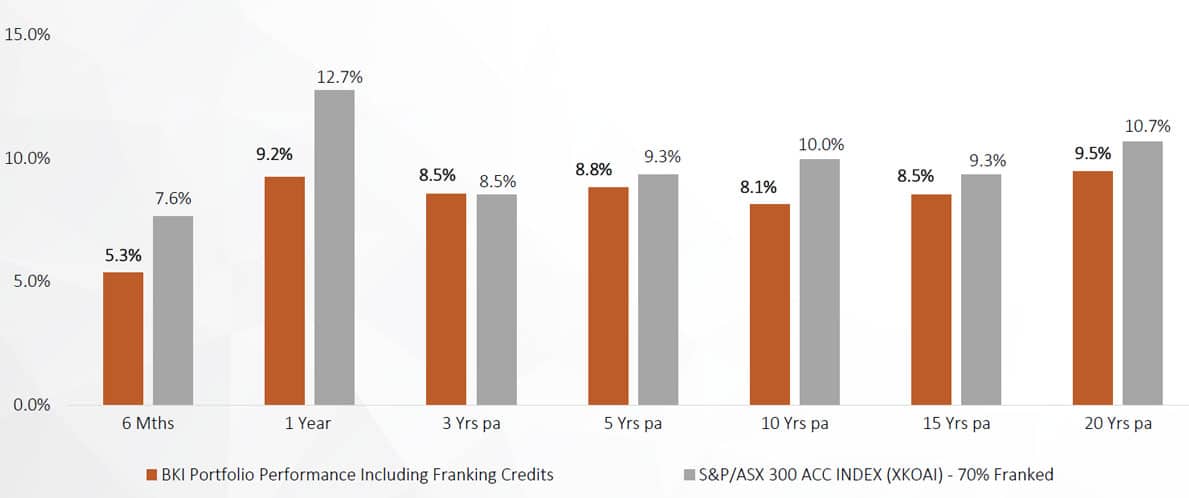

Long Term Performance

Since listing in 2003, BKI’s investment strategy has been and will continue to be focused on research driven, active equities management, taking a long term investment horizon and investing in quality companies with a history of paying attractive dividend yields.

Total Shareholder Returns

Source: BKI HY2025 Investor Presentation – link here, as at 31 December 2024.