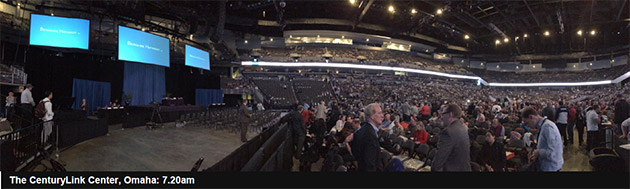

2014 AGM, Omaha, Nebraska.

Saturday, May 3, 2014

Warren Buffett and Bill Gates at the exhibition prior to the shareholders meeting.

After our unbelievable experience of 2013, the Chairman and I again attended the Berkshire Hathaway AGM in Omaha, Nebraska. It was another fantastic weekend, full of inspiration and insights into the worlds largest economy through the eyes of two of the worlds greatest investors and managers of some of their best investments.

The shareholders meeting consisted of 3 hours of Q&A, a 1 hour break, another 3 hours of Q&A, followed by the AGM. There were two panels; the first consisting of three financial journalists being Carol Loomis (Fortune), Becky Quick (CNBC), and Andrew Ross Sorkin (The New York Times). The second panel was made up of three analysts, Jonathan Brandt (Ruane, Cunniff & Goldfarb), Greggory Warren (Morningstar) and Jay Gelb (Barclays Plc).

While the 2013 meeting was focused on the US stock market and the economy, the theme of question time this year was quite different. There was a focus on owning and running businesses and what criteria Mr Buffett (WB) and Mr Munger (CM) look for when contemplating an acquisition.

“American business is doing extraordinarily well“ … “American business earnings on net tangible assets, the way to measure profitability overall, its basically the envy of the world”

– Warren Buffett

The issue of not paying dividends was brought up, with a question “Every year I see some of the old shareholders and they are waiting to get a dividend. I do not think it’s entirely fair for them to sell their shares…Is there a practical way to break up the company into four large groups?” Buffett: We would lose significant value if we were to break it into four companies. We would lose advantages in taxes, cash flow. BRK is worth more as presently constituted than in any other form…It would be a terrible mistake.” He quickly put to bed the issue with a slide on a resolution showing a 96.8% vote against the distribution of a dividend.

Included in this note are some further quotes and insights from not only Mr Buffett and Mr Munger but from some of the managers of BRK owned companies. We found them to be very informative. I’d like to also point out that as was the case in 2013, this was a self-funded trip with no expense to BKI shareholders.

Tom Millner; May 2014.

Cash is like Oxygen

BRK continue to look for that sizable investment to complement their existing portfolio. However they continue to wait until the right opportunity appears which is a great test of patience, principle and of their process.

WB “As we start 2014, we’ve got a really good group of businesses. What we’re trying to do is add on to them.”

However, they are the Kings of long term investing and one rule for long term investors to remember is to keep your powder dry – not having to sell one asset to fund another.

WB: “Berkshire has $40bln plus of capital, and we are willing to take that to $20bln….Cash is like oxygen. You don’t notice it 99% of the time but if it’s absent you notice it straight away. We will keep $20bn and we will never worry about any event that will prevent us from playing our game.”

2013 Berkshire Results

Insurance: Underwriting Profits grew from $1.6bln in 2012 to $3.1bln in 2013. Float has risen from $73.1bln to $77.2bln.

Regulated: Mid American grew Net Earnings from $1.5bln to $1.6bln in 2013; whilst BNSF grew Net Earnings from $3.3bln to $3.8bln.

Manufacturing, Service, Retail: Net Earnings for this group were up from $3.7bln in 2012 to $4.2bln in 2013.

Finance: Pre tax Earnings grew from $0.8bln to $1.0bln in 2013.

Investments: One Year Total Shareholder Returns as at 31 Dec included: American Express +60.0%, Wells Fargo +37.0% and The Coca-Cola Company +17.2%.

BRK have frequently stated publically that they are more likely to underperform the S&P500 Accumulation Index in a bull market and this year was no exception. For four of the last five years BRK, on an annual basis, has underperformed the index. However, since 1965, BRK’s Compound Annual Returns are 9.9%pa above the benchmark, a remarkable achievement.

WB: “We will underperform in up years”. CM: “In the last few years BRK value has increased over $60bln on a post tax basis…if this is failure, I want more.”

WB: “Size is an anchor to performance…We have heard many managers and analysts try and give us a calculation to determine cost of capital…we haven’t seen a reasonable one yet. The real test is that we make more money than we put in.” CM: “The real answer is that we are right and they are wrong!”

How to Buy a Business

Some people say that the metrics in buying a business outright is somewhat different to investing in stocks. I disagree. The following criteria (which were stated over and over again during question time) can be used when looking at acquiring a business or investing in the stock market.

• Competitive Advantage – Good businesses are industry leaders with a strong market share.

• Large Scale – “Our goal is to buy earnings power.”

• Continual Growth – A new investment must be a growing and participating in a growing sector.

• Good Management – In regards to NFM (Nebraska Furniture Mart) WB stated that “It was a wonderful opportunity to join as fine a family as I’ve ever met.”

• Understand the Company and the Brand

“It doesn’t matter what business you invest in, you just have to have good management, be well capitalized and for that capital to be then allocated correctly.”

“Sees Candy opened our eyes to the power of brands. There is nothing like owning a brand to educate you. In 1988 we bought Coca Cola and we might not have done so if we not owned Sees. Sees main contribution was ignorance removal. We were barely smart enough to buy it. If there’s any secret we have, its ignorance removal. And the nice thing is we still have a lot of ignorance left to remove.”

• Strong Balance Sheet

“Deploy capital properly, in a growing business in a growing sector.”

“Whilst cash is king, cash is the dumbest thing you can own if you hold it at the wrong time.”

• Pay a Reasonable Price – This can sometimes mean you pay fair value. “We bought NFM on 12X Annual Earnings, it was not a bargain purchase, it was a great business. Numbers are up 7% this year on last years record number.”

• Don’t Issue Too Many Shares – Don’t dilute your original business. “Don’t always buy companies by always issuing shares.”

• Know Your Market – The story of BRK has shown what the US can offer in terms of opportunity, scale and patriotism. “BRK would not have been able to achieve what it has in any other country. The US is a great country full of many great businesses and opportunities.”

• Know Your Limits… But Have Fun – WB and CM have worked side by side for many years. They are role models for many young investors. Having a soundboard is important, somebody you can bounce ideas off, somebody you can share success with and somebody you can have fun with along the way.

WB: “He (Charlie) is my canary in the coalmine. He turned 90 and I find it encouraging how he is handling middle age. I do think its very likely that whoever replaces me as CEO probably has or will develop somebody that they work with very closely. It’s a great way to operate. BRK is better off because the two of us have worked together. I would be very surprised that if a few years after my successor takes over, there isn’t some relationship or partnership that enhances the CEO’s not only achievements, but the fun they have.”

Discussions with Management

Discussions were held during the day with management of the following BRK owned companies. As a follow up from 2013, we gained excellent insights into how the US economy was placed. With a particular focus on Retail, Housing, Manufacturing and infrastructure, we came away from the day with a very positive view of the US economy. Last year Buffett didn’t expect to see the economy fall into a double dip recession nor did he think the economy was going to shoot the lights out. What he did say was that he expected to see “a slight and gradual uplift in the economy over time.” Once again he was right; that time of a slight and gradual uplift seems to be unfolding right now.

Forest River – Manufacturer of motor homes and towable RV’s, trailers and boats Forest River and main competitor Thor Industries Inc have approx 84% market share of the RV and camper industry. Baby boomer growth in the US is extensive and growing. The lower priced US Dollar encourages travelers to stay local. Profit margins are said to be approximately 11%. The value of the 40ft motor home on display was US$185k, verses Austrian Jayco equivalent worth AUD$288k.

BNSF – North America’s leading freight transportation company. Very long term assets, priced on periodic regulation and contracts. Transports 15% of all inter-city freight by rail, roal, pipeline, water or air. 53% market share. Gives BRK first hand data into the US economy through carloads movements and volumes.

Justin Boots – Market leader in western, work and outdoor footwear and accessories. Has seen over 15% growth for the past 2 years. Import V’s local manufacture is now 50/50. Work boot growth has been “huge”. Justin has been very clever in making sure their work boots are manufactured locally, ensuring the workers support a local product. Hide supply is becoming difficult, sourcing from Mexico, Brazil and even China. Looking at expanding to markets outside the US.

Benjamin Moore & Co – North America’s leading manufacturer and retailer of premium paints and stains. Seen a big pick up in volumes across all divisions. 6 month lag from building approval to furnishing phase (substantially quicker than in Australia). Baby boomer market driving a lot of volumes through downsizing. Housing market seen as strong in most sectors. IT programs are contributing to sales volume – through launch of aps and programs driving inspiration. Sales distribution currently 30% retail outlets and 70% through distributors (Lowes and Home Depot), with DIY market 31% of sales.

Brooks – Leading manufacturer and designer of footwear and apparel. Sales growth over 19% in 2013. Strong push for fitness in the US to combat the fight against obesity, Computers and smartphones. Very cold winter has had an impact on sales for the 1st quarter. R&D continues to focus on higher end product and demographic. Retail confidence definitely coming back – driven by strong housing market, job security and continual low borrowing rates.

The Coca-Cola Company – Worlds leading manufacturer, marketer and distributor of beverage concentrates and syrups. Trying to be on the front foot with sugar and obesity issues, using portion control, advertising and new products. Coke Zero gaining significant traction and surprising on the upside, believe the Coca-Cola brand is still very strong.

GEICO Insurance – Insurance company offering plans for vehicle, life and property. Currently has a 10% market share across the US. Grew Underwriting profits by 66% and Earned Premiums by 11%. Growth expected to continue in both categories but more so in vehicles with 1.4m new vehicle sales recorded in April 2014 (up 8%), with the US now on track to sell over 16m new vehicles per annum. Float has grown to $12.6bln, up from $11.6bln in 2013. To put this number in context, Australia sells approximately 1m new vehicles per annum.

Nebraska Furniture Mart – Americas largest volume home furnishings store. Expansion into Texas is on track. Sticking to the destination ‘bricks and mortar’ business will place this site very well for many years to come.

Retail

“The retail sector is strong with confidence levels improving month by month.”

“There is less emphasis on job security.”

“Low interest rates are encouraging people to spend.”Housing

“Valuations are bouncing off historical lows to levels in most cases seen before the GFC.”

“Downsizing is driving up the mid tier market.”

“New build numbers are improving.”Manufacturing

“Manufacturing has some way to go, China is still a cheap option.”

“There is a lot of loyalty to products that are made here in the US.”